Visiting Navx: An Inside View Into Auto Content Curation

1 October 2014

Not long ago GPS Business News had the opportunity to spend two days at Navx’s “Content Factory“ in Bucharest, Romania. Navx, headquartered in France, offers content to car makers and GPS navigation vendors.

The briefings at their Content Factory was an interesting experience that offered an insight view into their core business: providing verified, quality content to the auto industry: fuel prices, parking data and electric vehicle charging in tens of countries.

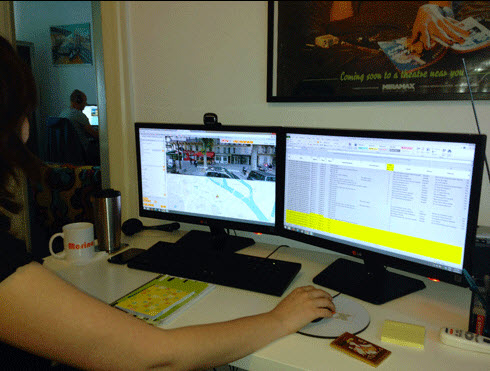

Navx mixes automated data processing with a sizeable amount of manual verifications, i.e. between 5,000 and 8,000 phone calls are made per month to verify the data accuracy.

In the video below a Navx data analyst demonstrated us their process to verify fuel prices directly at the source.

GPS Business News also interviewed with Jean Cherbonnier, founder of Navx to get a broad overview of the company and understand the specificity of its content aggregation and curation.

GPS Business News:

What is the core mission of Navx?

Jean Cherbonnier: Navx is devoted to producing automotive-grade content for connected cars worldwide. We source, collect, verify and aggregate data, which we then deliver to our clients in the car industry.

GPS BN: What is your business model?

JC: Navx’s content is sold as a Data-as-a-Service (DaaS) solution, distributed either directly to car manufacturers or through OEM's partners.

We price our solutions per new vehicle sold and per year, usually on a 3-year contract basis. We therefore transform a complex and fragmented patchwork of sources, cost structures, languages and currencies into a simple model to deal with for a car maker: they get 25 countries through one API, one service-level agreement, one business model.

GPS BN: What are your key content categories and their geographical coverage ?

JC: We focus on content categories that have a real-time component, and that are core to the car driver’s experience. They are today fuel prices, parking information and electric charging stations. Our efforts are focused on expanding our geographic coverage, while at the same time improving the quality of our data. As of today, we cover 25 countries with fuel price data, 50 with parking information and 6 with EV charging station location.

GPS BN: What are your current customers in the automotive industry and beyond?

JC: We have 9 large clients in the Automotive industry: Audi, BMW, Citroën, Daimler, Peugeot, Mazda, Nissan, Renault and Toyota. Beyond the Automotive industry, we also work with mobile operators and PND manufacturers, as well as several companies outside the navigation industry which are interested in our data collection process.

GPS BN: What is the secret sauce to aggregate and create quality content, what is your experience at that level?

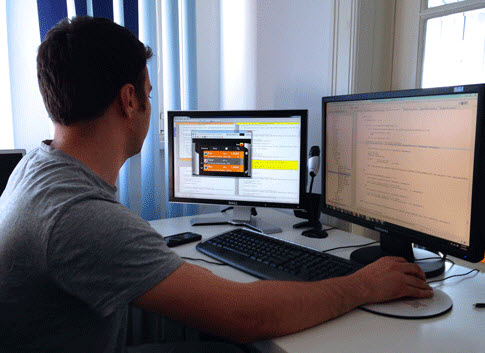

JC: Producing content for the Automotive industry requires the optimal combination of automation (to be scalable) and manual processes (to control and guaranty quality).

We mostly rely on three elements. First, an efficient content management system, to process data. Second, a team of content analysts, dedicated to each content category, to insure the highest quality; and third, a fast-moving sourcing activity, to identify and integrate new sources of information on the fly.

As a result, we are capable of opening a new country in a matter of a few months.

GPS BN: Talking specifically about fuel prices, there are strong differences country by country, can you pinpoint a few of those?

JC: Major differences between countries are fuel types and price volatility.

Fuel types vary from one country to the other in terms of availability (for instance the E10 is provided in some countries but not others) and naming (e.g Diesel, Gasóleo, ON and Motorin are all the same fuel type but in different countries). It is therefore important to provide drivers clear information about compatible fuel types for their car.

Price volatility also varies significantly: price can change twice a month (in Brazil, Russia), twice a week (in France, UK, etc) or even 4 times a day (in Germany). We must therefore adapt our collect process and KPI monitoring to those different situations.

Other important differences are the density of fuel stations, the level of consolidation, the intensity of competition between stations, all factors having an impact on price fluctuations, and therefore on our efforts to maintain an up-to-date database.

GPS BN: For electric vehicle charging station, how do you cope with the different connectors? do you see standardization happening? In terms of coverage, do you see large deployments of new stations happening in Europe now?

JC: There are about 20 different types of connectors! And standardization is a slow process, so we need to maintain an up-to-date matrix of compatibility, and hide complexity from end-users.

Overall, the market is still at an early stage, and several major obstacles limit its development. Most notably having a personal wallbox is not easy, cars are expensive, the coverage of EV stations is insufficient).

However, a few countries such a the Netherlands or Norway, and some cities such as Paris, London and Lyon, have deployed a significant network of EV stations. It gives an indication of where the market will be in a few years. We expect the number of EV charging points to reach 500,000 in Europe within 3 years.

Eventually, we think hybrid plugin cars should be the future, mixing the best of two worlds (electric mode in cities, fuel mode on motorways).

GPS BN: In the parking industry how much is real-time data (space availability) versus static data? How fast are parking operators moving towards real-time data?

JC: Navx currently provides static information (location, opening hours, tariff plans) and dynamic information (availability) for off-street parks. Availability information is important, particularly in crowded areas near stadium, touristic zones and business centers.

However, even with cities and governments increasing pressure on parking operators to publish real-time availability, many countries are lagging behind (only in 5 to 20% parking sites depending on the country in Europe).

We expect things to change in the future with two trends. First, on-street parking information will become increasingly available as consumers use parking mobile apps that monitor their driving behavior and infer the location of available parking spots. That will encourage parking operators to reconsider their current reluctance to share their data.

Secondly, as booking and payment will become available through a car embedded systems, parking operators will be able to measure the benefits of providing real-time information to car drivers.

GPS BN: What is the quality level your are committing to?

JC: The connected car is an emerging market where both OEMs and content providers need to build mutually beneficial relationships. By committing to a strong Service Level Agreement, we recognize the importance of quality for the car maker, its brand, its relationship with its clients.

We have therefore established key performance indicators to monitor quality, which we share with our clients, along with our roadmap of countries, products and services. We report the coverage, freshness and accuracy of our data, on a country per country basis and source per source basis. This allows to build mutual trust, plan in advance and help car makers to differentiate their offers.

GPS BN: How is the company doing: profitability, growth, revenue ?

JC: The company has been profitable for a several years already, with growing revenues, and we reinvest our profits in expanding our geographic coverage and increasing quality.

GPS BN: Moving forward what is the future for NAVX ?

JC: NAVX will keep expanding geographically and increasing the quality of its content. On top of that, our objective is to add booking and payment solutions to our content, in order to build innovative business models, such as fuel coupons, and parking or EV booking services. In addition, as connected vehicles become predominant, we intend to partner with OEM and car makers, to combine real-world data processed by our content factory, with sensors-generated data, to produce a unique and valuable information that can be used by car drivers.

Via

The briefings at their Content Factory was an interesting experience that offered an insight view into their core business: providing verified, quality content to the auto industry: fuel prices, parking data and electric vehicle charging in tens of countries.

Navx mixes automated data processing with a sizeable amount of manual verifications, i.e. between 5,000 and 8,000 phone calls are made per month to verify the data accuracy.

In the video below a Navx data analyst demonstrated us their process to verify fuel prices directly at the source.

GPS Business News also interviewed with Jean Cherbonnier, founder of Navx to get a broad overview of the company and understand the specificity of its content aggregation and curation.

GPS Business News:

What is the core mission of Navx?

Jean Cherbonnier: Navx is devoted to producing automotive-grade content for connected cars worldwide. We source, collect, verify and aggregate data, which we then deliver to our clients in the car industry.

GPS BN: What is your business model?

JC: Navx’s content is sold as a Data-as-a-Service (DaaS) solution, distributed either directly to car manufacturers or through OEM's partners.

We price our solutions per new vehicle sold and per year, usually on a 3-year contract basis. We therefore transform a complex and fragmented patchwork of sources, cost structures, languages and currencies into a simple model to deal with for a car maker: they get 25 countries through one API, one service-level agreement, one business model.

GPS BN: What are your key content categories and their geographical coverage ?

JC: We focus on content categories that have a real-time component, and that are core to the car driver’s experience. They are today fuel prices, parking information and electric charging stations. Our efforts are focused on expanding our geographic coverage, while at the same time improving the quality of our data. As of today, we cover 25 countries with fuel price data, 50 with parking information and 6 with EV charging station location.

GPS BN: What are your current customers in the automotive industry and beyond?

JC: We have 9 large clients in the Automotive industry: Audi, BMW, Citroën, Daimler, Peugeot, Mazda, Nissan, Renault and Toyota. Beyond the Automotive industry, we also work with mobile operators and PND manufacturers, as well as several companies outside the navigation industry which are interested in our data collection process.

GPS BN: What is the secret sauce to aggregate and create quality content, what is your experience at that level?

JC: Producing content for the Automotive industry requires the optimal combination of automation (to be scalable) and manual processes (to control and guaranty quality).

We mostly rely on three elements. First, an efficient content management system, to process data. Second, a team of content analysts, dedicated to each content category, to insure the highest quality; and third, a fast-moving sourcing activity, to identify and integrate new sources of information on the fly.

As a result, we are capable of opening a new country in a matter of a few months.

Florent Boutellier (right) and Jean Cherbonnier (left) co-founders and managing directors of Navx

GPS BN: Talking specifically about fuel prices, there are strong differences country by country, can you pinpoint a few of those?

JC: Major differences between countries are fuel types and price volatility.

Fuel types vary from one country to the other in terms of availability (for instance the E10 is provided in some countries but not others) and naming (e.g Diesel, Gasóleo, ON and Motorin are all the same fuel type but in different countries). It is therefore important to provide drivers clear information about compatible fuel types for their car.

Price volatility also varies significantly: price can change twice a month (in Brazil, Russia), twice a week (in France, UK, etc) or even 4 times a day (in Germany). We must therefore adapt our collect process and KPI monitoring to those different situations.

Other important differences are the density of fuel stations, the level of consolidation, the intensity of competition between stations, all factors having an impact on price fluctuations, and therefore on our efforts to maintain an up-to-date database.

GPS BN: For electric vehicle charging station, how do you cope with the different connectors? do you see standardization happening? In terms of coverage, do you see large deployments of new stations happening in Europe now?

JC: There are about 20 different types of connectors! And standardization is a slow process, so we need to maintain an up-to-date matrix of compatibility, and hide complexity from end-users.

Overall, the market is still at an early stage, and several major obstacles limit its development. Most notably having a personal wallbox is not easy, cars are expensive, the coverage of EV stations is insufficient).

However, a few countries such a the Netherlands or Norway, and some cities such as Paris, London and Lyon, have deployed a significant network of EV stations. It gives an indication of where the market will be in a few years. We expect the number of EV charging points to reach 500,000 in Europe within 3 years.

Eventually, we think hybrid plugin cars should be the future, mixing the best of two worlds (electric mode in cities, fuel mode on motorways).

GPS BN: In the parking industry how much is real-time data (space availability) versus static data? How fast are parking operators moving towards real-time data?

JC: Navx currently provides static information (location, opening hours, tariff plans) and dynamic information (availability) for off-street parks. Availability information is important, particularly in crowded areas near stadium, touristic zones and business centers.

However, even with cities and governments increasing pressure on parking operators to publish real-time availability, many countries are lagging behind (only in 5 to 20% parking sites depending on the country in Europe).

We expect things to change in the future with two trends. First, on-street parking information will become increasingly available as consumers use parking mobile apps that monitor their driving behavior and infer the location of available parking spots. That will encourage parking operators to reconsider their current reluctance to share their data.

Secondly, as booking and payment will become available through a car embedded systems, parking operators will be able to measure the benefits of providing real-time information to car drivers.

GPS BN: What is the quality level your are committing to?

JC: The connected car is an emerging market where both OEMs and content providers need to build mutually beneficial relationships. By committing to a strong Service Level Agreement, we recognize the importance of quality for the car maker, its brand, its relationship with its clients.

We have therefore established key performance indicators to monitor quality, which we share with our clients, along with our roadmap of countries, products and services. We report the coverage, freshness and accuracy of our data, on a country per country basis and source per source basis. This allows to build mutual trust, plan in advance and help car makers to differentiate their offers.

GPS BN: How is the company doing: profitability, growth, revenue ?

JC: The company has been profitable for a several years already, with growing revenues, and we reinvest our profits in expanding our geographic coverage and increasing quality.

GPS BN: Moving forward what is the future for NAVX ?

JC: NAVX will keep expanding geographically and increasing the quality of its content. On top of that, our objective is to add booking and payment solutions to our content, in order to build innovative business models, such as fuel coupons, and parking or EV booking services. In addition, as connected vehicles become predominant, we intend to partner with OEM and car makers, to combine real-world data processed by our content factory, with sensors-generated data, to produce a unique and valuable information that can be used by car drivers.

Via